www.tax.ny.gov basic star exemption

To apply to STAR a new applicant must. To be eligible for a STAR check you must register with the New York.

The School Tax Relief Star Program Faq Ny State Senate

STAR Tax Exemption Registration.

. To be eligible for Basic STAR your income must be 250000 or less. Basic STAR Exemption and Star ENHANCED Exemption. The deadline to file for all exemptions is March 1.

You may be eligible for Enhanced STAR if. Call 311 Outside New York City call 212-NEW-YORK Nassau County residents Glen Cove residents should follow the general application. Available if you own and occupy a residential property with federally adjusted gross income.

All questions regarding the new BASIC STAR exemption program or about the status of applications previously filed with that office must be directed to ORPTS. Use Form RP-425. More than 17 million New York homeowners have registered for their Basic STAR property tax exemptions.

You currently receive Basic STAR and would like to apply for Enhanced STAR. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. If they qualify they will receive a STAR credit in the form of a check rather than receiving a property tax exemption.

STAR helps lower property taxes for eligible homeowners who live in New York State school districts. The following security code is necessary to prevent. Learn More At AARP.

To qualify the adjusted gross income must be under the State. A manufactured homeowner who received a letter that you must register for the STAR credit to continue receiving a STAR benefit Form RP-425-RMM. Basic STAR is for homeowners whose total household income is 500000 or less.

Enter the security code displayed below and then select Continue. The following security code is necessary to. Star School Tax Relief Basic Exemption.

Resident homeowners applying for STAR for the first time are not affected by this years registration procedure. To learn more about STAR. Enter the security code displayed below and then select Continue.

Exemption forms and applications. Beginning in 2016 any homeowner who is applying for the first time on a property meaning you have NEVER had any STAR exemptions. If qualified you will receive a STAR credit in the form of a check rather than a property tax exemption.

The Basic STAR application is for owners who were in receipt of the STAR exemption on their property as of the 2015-16 tax year but later lost the benefit and wish to restore it. To qualify the adjusted gross income must be under the State. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

If qualified you will receive a STAR credit in the form of a check rather than a property tax exemption. STAR Check Delivery Schedule.

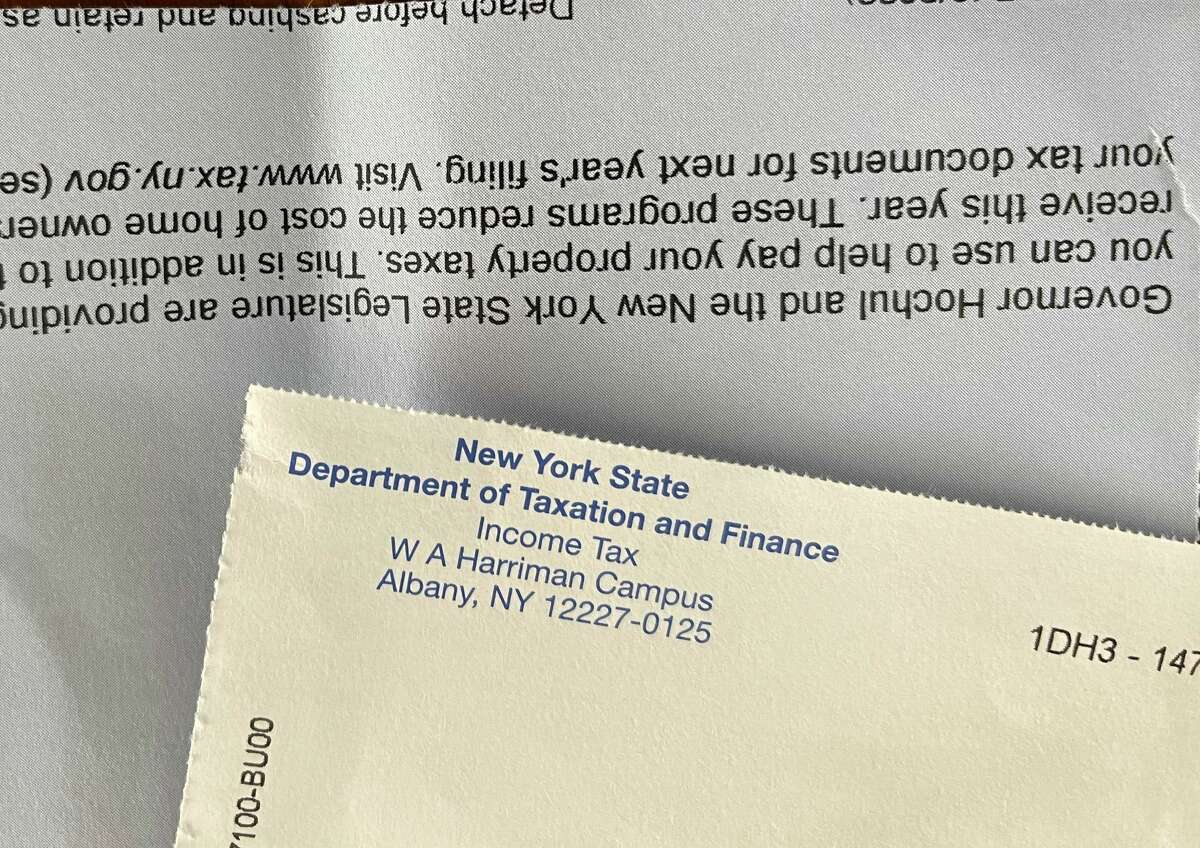

New York Property Owners Getting Rebate Checks Months Early

Electric Car Market Share Financial Incentives Country Comparison Incentive Financial Share Market

Condo Closing Timeline Nyc Hauseit Nyc Condo Buying A Condo

What Is The Enhanced Star Property Tax Exemption In Nyc Nyc Condo Buying A Condo Property Tax

Front Desk Resume Example Template Modern Resume Examples Front Desk Agent Job Resume Examples

Pros And Cons Self Managed Condo And Co Op Buildings In Nyc Hauseit Condo Buying A Condo Building

New York State Secure Choice Savings Program Board

New York Property Owners Getting Rebate Checks Months Early

The School Tax Relief Star Program Faq Ny State Senate

Trump S Taxes Show Chronic Losses And Years Of Income Tax Avoidance The New York Times

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Tioga Opportunities Inc

Receiver Of Taxes Town Of Oyster Bay

Social Media Marketing Social Media Social Media Marketing Marketing Support

Karl Hubenthal Illustrator Vintage Football Sports Art American Football League